- You are here:

-

Home

-

Asian e-Marketing

-

February 2011

- Social Networks’ Future Growth Prospects

-

Yahoo integrated approach for advertising in a cookieless world

Yahoo Advertising announced a new integration with Twilio Segment Customer Data Platform (CDP) to drive greater advertising reach and relevance, without relying on third-party cookies.

-

Outlook of generative AI for the enterprise market is exciting but lacks a clear corporate strategy

The democratization and acceleration of generative Artificial Intelligence (AI) originated in the business-to-consumer (B2C) market with the release of popular applications like ChatGPT and Stable Diffusion. But the B2C market will barely scratch the surface of generative AI’s potential economic value.

-

New Apps, New Data, and New Resilience: Huawei Proposes Ways of Evolving Storage in the Yottabyte Era

The Innovative Data Infrastructure Forum (IDI Forum) 2023, revolving around the theme of "New Apps ∙ New Data ∙ New Resilience," took place on May 23 in Munich, Germany. The Forum brings together global industry experts and partners to explore the future of digital infrastructure towards the yottabyte era (a yottabyte is equal to a quadrillion gigabytes).

-

Revealed: The most creatively effective digital & TV ads in Southeast Asia

The marketing data and analytics company, Kantar, revealed the winners of the 2023 Creative Effectiveness Awards in Southeast Asia, recognizing the most impactful ads of last year.

-

How AI will change the way we work in Asia Pacific

Microsoft introduced Microsoft 365 Copilot earlier this year, which will bring powerful new generative AI capabilities to apps millions of people use every day like Microsoft Word, Excel, PowerPoint, Outlook, Microsoft Teams and more.

-

Mindful Employer Branding Key to Successful Staff, HR Recruitment

In modern society, building an inclusive employer brand should be considered mission critical for businesses large and small. The most successful companies are the ones that see challenges and opportunities from many different angles, and having a diverse employee population allows you to do just that. An inclusive employer brand lets you engage, recruit, and hire a wonderful spectrum of people who can bring their varied backgrounds to bear for your business. Simply put, building an inclusive employer brand brings a diverse set of experiences and perspectives to the table, which in turn allows your company to be smarter, more thoughtful, and ultimately more successful.

-

Fastest web-based editor released for a new era of storytelling across streaming, broadcast, digital and social media

Dalet, a leading technology and service provider for media-rich organizations, announced the release of Dalet Cut, the cloud-native, real-time, lightning-fast multimedia and multiplatform editor fully integrated within the Dalet ecosystem.

-

Advertisers' awareness of cookieless technologies remains low according to global survey

Ogury, a global leader in personified advertising, commissioned IDC to conduct a global survey on 1,000 major brand and media agency executives to get their perspective and understanding of the future of digital advertising in a cookieless world.

-

IBM Unveils the Watsonx Platform to Power Next-Generation Foundation Models for Business

At its annual Think conference, IBM announced IBM watsonx, a new AI and data platform, planned to be released in July 2023, that will enable enterprises to scale and accelerate the impact of the most advanced AI with trusted data.

-

Majority of APAC consumers are willing to sacrifice data security for convenience

F5's latest Curve of Convenience 2023 report shows data security taking a back seat with APAC consumers, with an increased willingness to save and share personal payment data on multiple platforms.

-

Cisco unveils new solution to rapidly detect advanced cyber threats and automate response

Cisco unveiled the latest progress towards its vision of the Cisco Security Cloud, a unified, AI-driven, cross-domain security platform. Cisco's new XDR solution and the release of advanced features for Duo MFA will help organizations better protect the integrity of their entire IT ecosystem.

-

Comprehensive protection measures a must to prevent data leaks and theft

Remote work, home office or hybrid work, have become the norm in today's business world and that most likely will stay that way. But the more employees work remotely, the greater the company's risk of falling victim to a cyberattack, making a sophisticated and multi-layered security concept the more essential for any company.

-

Alibaba Cloud unveils new AI Model to support enterprises' intelligence transformation

Alibaba Cloud, the digital technology and intelligence backbone of Alibaba Group unveiled its latest large language model, Tongyi Qianwen.

-

SecurityHQ’s Cyber Predictions

In response to the growing number of breaches, SecurityHQ released their latest white paper to highlight analyst predictions for threats and vulnerabilities in H2 2023.

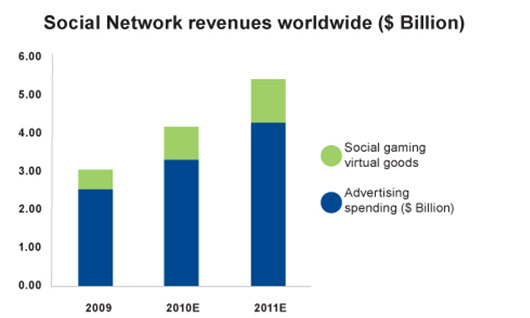

According to Deloitte, social networks will most probably surpass the breathtaking milestone of one billion unique members in 2011 and deliver over two trillion advertisements, implying advertising revenues of about $5 billion.

According to Deloitte, social networks will most probably surpass the breathtaking milestone of one billion unique members in 2011 and deliver over two trillion advertisements, implying advertising revenues of about $5 billion.