The holiday season in Singapore accounts for over 20% of online sales, since online retailers such as Amazon, Lazada and Qoo10 have left no stone unturned when it comes to attracting and encouraging consumers to embark on a shopping spree during the end of year sales.

The holiday season in Singapore accounts for over 20% of online sales, since online retailers such as Amazon, Lazada and Qoo10 have left no stone unturned when it comes to attracting and encouraging consumers to embark on a shopping spree during the end of year sales.

A special applause must go to Amazon, which launched just a year ago in Singapore, but has quickly risen to the top by capturing 51% share of social engagement.

Digital connectivity may have been a boon for consumers, but retailers clearly have had to adapt to technological shifts and get active on social media.

The leading Social Media Marketing platform Socialbakers just revealed which brands gained the most interactions from fans on social media platforms – Facebook and Instagram, leveraging the largest social media data-set in the industry. Socialbakers’ AI-powered social media marketing suite helps brands to figure out how to invest in social media to get the highest ROI by tracking 10 million social profiles across all major social platforms including Facebook, Instagram, Twitter, YouTube, LinkedIn, Pinterest, Google+, and VK.com.

For instance, in Singapore, Singles’ Day witnessed that its sales figures have doubled that of last year’s. Black Friday has also increasingly gained popularity, with both online and physical brands taking part in the post-Thanksgiving festivities to extend the ultimate holiday discounts for bargain hunters.

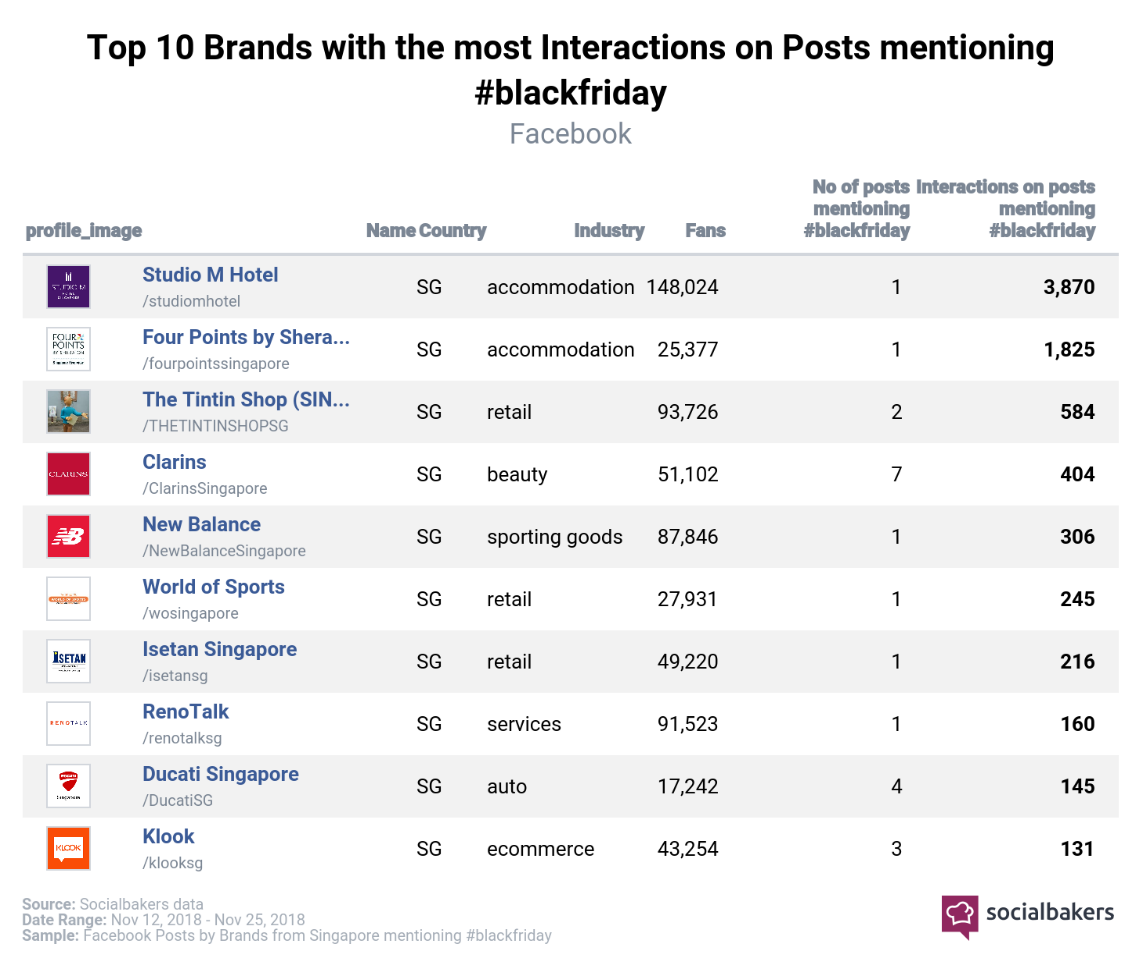

Singaporeans are known to almost never miss out on a good bargain, and this year’s Black Friday sales were a true testament to that. But which brands were Singaporeans most excited to shop at? While many would expect that retail and e-commerce brands would dominate the charts, it was surprising to see hotels (Studio M and Four Points by Sheraton), automotive brands (Ducati) and a renovation firm join the ranks. The hotels also performed better than retail and beauty brands this year, with Studio M garnering 3,870 interactions on its Black Friday post on Facebook.

While many would expect that retail and e-commerce brands would dominate the charts, it was surprising to see hotels (Studio M and Four Points by Sheraton), automotive brands (Ducati) and a renovation firm join the ranks. The hotels also performed better than retail and beauty brands this year, with Studio M garnering 3,870 interactions on its Black Friday post on Facebook.

Not to get surprised next year, you might want to start preparing already?

IGD’s top trend predictions for next year might be useful, since it forecasts social shopping, health and freshness, to influence Asia’s grocery retail market over the next five years.

According to Nick Miles, Head of Asia-Pacific of the international grocery research organization, IGD, “the offline and online worlds continue to merge, and new technology is being used to make operations more efficient. In 2019, we expect this pace of change to continue. Retailers will keep refining their operations to meet growing demand for convenience; partnerships will continue to shape the future of online; health and wellness and social media are set to grow in importance; and in-store technology will fundamentally change the way people shop.”

Looking to next year and beyond, IGD has identified five key trends expected to shape Asia’s grocery market and influence retailer strategy, revealing what this means for suppliers in the region:

1. Ultimate convenience: Changing lifestyles mean shoppers across Asia are becoming increasingly demanding. Shopping little and often is a growing trend and consumers expect to be able to source products anywhere, anytime and anyhow they like. Retailers are adapting their operations to respond to this – convenience store chains continue to rapidly expand their networks, stores are using space in new ways, retailers are developing smaller and more unique stores, and online delivery times are being cut.

2. Partnerships shaping the future of online: Over the past few years, major partnerships have helped share expertise and accelerate online growth across Asia. These partnerships come in many forms, with retailers, suppliers and technology businesses increasingly looking to blur the boundary between the offline and online worlds. In 2019, IGD expects to see more partnerships emerge, existing ones develop further and the influence of Asia’s largest online players to spread across the region.

3. Health and freshness at the heart: Increasing levels of affluence, improved education, targeted government campaigns and historical food safety scares mean that Asian shoppers are increasingly aware of the importance of healthy living, fresh food, nutrition and product sourcing. Retailers are responding by highlighting healthy ranges and freshness using innovative concepts, layouts and technologies.

4. Social shopping: Social commerce is rapidly growing in importance across Asia. Brand communication via social media platforms is commonplace, influencing shopper behavior and providing smartphone users with easy ways to shop online. New innovations will continue to emerge in 2019, as retailers and suppliers deliver targeted marketing and new ways to make online shopping more social.

5. Technology transformation: Asian consumers are exceptionally open to new technology. In 2019 we will be keeping a close eye on digital and technological innovations in Asia, particularly those helping retailers to differentiate their offer, raise service levels, develop stores that are set up for an online future, and deliver more efficient operations in the face of rising costs.

Technology is clearly the game changer in the retail industry in Asia, defining not only how brands interact with shoppers, but enabling them to reduce costs and improve efficiency.

By MediaBUZZ