According to GroupM's "This Year, Next Year" Global Mid-Year Forecasts, global advertising revenues are expected to grow significantly – despite fears of an imminent recession and the ongoing geopolitical situation in the world.

According to GroupM's "This Year, Next Year" Global Mid-Year Forecasts, global advertising revenues are expected to grow significantly – despite fears of an imminent recession and the ongoing geopolitical situation in the world.

“Coming off the lows of 2020 and the highs of 2021, the advertising market is settling into 2022, a year that’s seeing rising inflation, increased wages, mounting regulatory pressure on Big Tech and an overall effort by consumers and marketers to find their footing in a world that’s getting increasingly used to living with COVID-19,” GroupM states.

For the future, however, GroupM does not expect any dangerous economic situation that could halt growth, justifying this optimistic assessment with low unemployment figures, high savings deposits in private households and "robust start-ups".

The proliferation of new small businesses, “coupled with their likely propensity to advertise at higher levels than the business they are replacing, venture-funded ‘new economy’ advertisers seeking growth and Chinese-based marketers advertising abroad are significant sources of growth despite some drag brought on by the (expected) deceleration of e-commerce and interest rate hikes. Even as individual advertising channels are becoming more digital in nature, diversification remains an important tool in every marketer’s toolbox. Laws are changing, economies are in flux and media are evolving rapidly, but there is still ample room for advertising growth and for adaptable marketers to succeed,” GroupM forecasts.

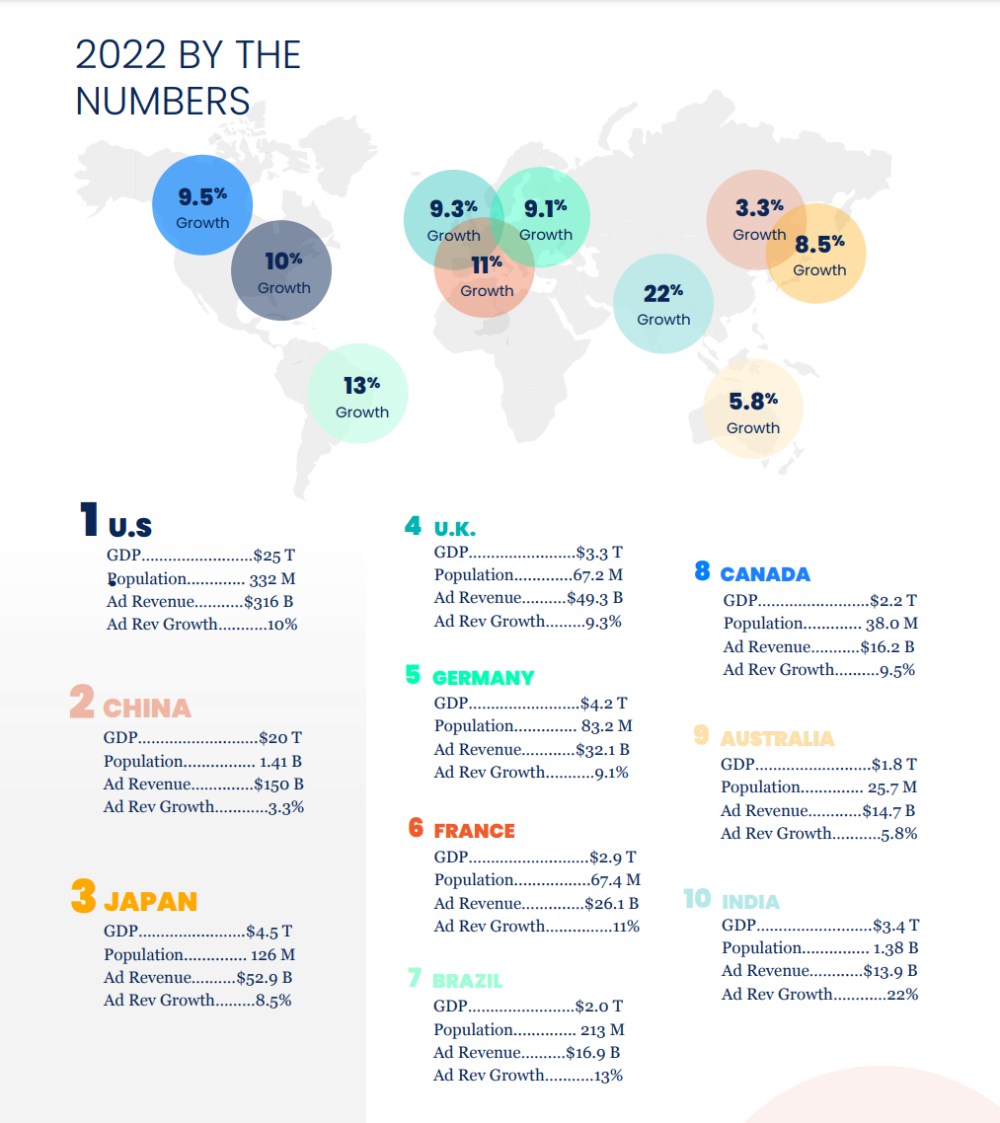

The most important results of the overall forecast:

- Advertising is expected to grow around the world by 8.4% in 2022 (excluding US political advertising), which is slightly below GroupM’s prior 9.7% forecast in December 2021.

- Within APAC, growth of 5.7% is expected, despite China’s relative weakness that represents 56% of the region. Excluding China, regional growth is forecast to be 9.0%, compared to 8.1% previously.

- Japan, still the world’s third-largest advertising market, is forecast to grow at a faster pace (8.5%) than previously anticipated (5.6%), and without the benefit of a broadly inflationary economy.

- Growth in India is predicted to remain strong (22.1%) and to rise from its position as the world’s tenth-largest market to become the seventh largest by 2025.

- Australia is expected to grow more modestly, although current levels of inflation are more moderate there than in North America or Europe.

- South Korea is expected to grow at a much slower pace, up only 1.0% under current expectations versus 1.8% previously.

The predictions at the halfway point in 2022:

- Digital Advertising: GroupM expects ad revenue for digital-only platforms to grow 12 percent in 2022, an expected slowdown from the 30% growth rate in 2021.

- Taking a broader definition of digital advertising to include traditional media's digital channels, GroupM estimates the industry will generate $617 billion in 2022, which is 73% of its total.

- TV Advertising: Projected growth of 4% in 2022. Notably, according to GroupM, TV is globalizing in a way it has never been before. U.S.-based streaming services continue to invest aggressively in local-language content as they expand into overseas markets.

- Connected TV environments, including streaming services' digital advertising inventory, will hog much more of existing budgets than they will bring new budgets into the industry.

- While television continues to outperform many alternatives when it comes to meeting reach and audience goals, GroupM continue to encourage marketers to try alternative strategies.

- OOH Advertising: The average market is expected to grow 12 percent as many of the markets it includes are nearing or are soon to exceed their pre-pandemic highs. GroupM expects out-of-home advertising next year to surpass 2019 volumes, suggesting that much of the current growth can still be characterized as recovery driven.

The top five advertising providers in 2021, which include Google, Facebook, Alibaba and Bytedance, will generate $408 billion in advertising revenue, or 53% of the global total.

By Daniela La Marca