Recently, SAS made several significant announcements at their Premier Business Leadership Series conference in Orlando, Florida.

Recently, SAS made several significant announcements at their Premier Business Leadership Series conference in Orlando, Florida.

According to the leader in business analytics, “the rise of the information society has provided a wealth of opportunities for organizations to enhance services to customers through new channels. These have helped to save time, money and effort from an operational perspective. But on the opposite end, cybercriminals are finding new ways to exploit weaknesses and working to develop ever more sophisticated methods of attack – or finding high-tech reinventions of old tricks. The cost to consumers, and to society as a whole, is growing, while a lack of international cooperation allows the trend to continue”.

SAS’s research intends to help organizations thrive on data, stay ahead of the competition and transform their organization for future success. So take a look at some of the top announcements, I think you might be interested in:

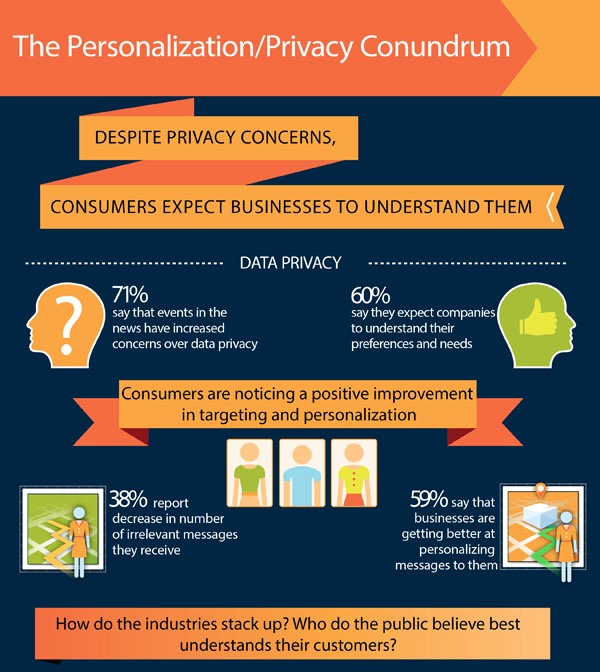

- SAS’s recent study reveals that despite the current public consternation over government access to personal data, the spotlight is once again on consumers’ concerns over data privacy. But when organizations use personal data responsibly, the new study found out that consumers are happy when they are understood: While 71% of the 1,260 respondents surveyed said that recent news increased their privacy concerns, a hefty 60% still expect businesses to know their preferences and understand their needs.

See the infographic on the Personalization/Privacy Conundrum

- SAS reports further that banks lack ammo to fight cyber-threats, stating that evolving security threats, technology limitations and simple lack of awareness make cyberrisk a daunting hurdle for today's banks. The recent survey – Cyberrisk in Banking - conducted by Longitude Research and sponsored by SAS reveals that lost customer trust is the most significant impact of cyberattacks – nearly double that of monetary losses.

Although many of these threats are basic, like simple spam or phishing emails, the threat landscape is getting more and more complex. There is a convergence of offline fraud and online crimes, especially in financial services institutions: just consider the recent attacks in which international hackers steal data that is then used by local criminals to fraudulently withdraw money from banks. Besides that, cybercriminals usually look for the weakest links in the information supply chain, which means institutions can come under indirect attack even when their own systems are secure. Third-party providers and other actors hold massive amounts of data about consumers, making them targets as well.

- SAS highlighted Data Management in addition, which simplifies “Big Data” for organizations which struggle to quickly gain value from all available data. SAS has updated its SAS® Data Management to empower business users to fit data to match their needs while accommodating IT data management practices. Indeed, leading organizations look to data management and analytics for being able to make risk-based decisions, which can help them better anticipate the nature of threats and determine the most appropriate action to meet them.

The recent leaks by Edward Snowden, the American who exposed US government activities in collecting and analyzing big data, show that governments have long used such approaches to gather intelligence. Now, leading financial institutions are looking at similar techniques to predict the threats that they face.

So, take the advice and start identifying the scope of the cyberrisks you face today, before delving into particular challenges or conclusions. Cybersecurity affects us all and can have major ramifications even if seemingly mundane. (Source: SAS)

By MediaBUZZ