Page 6 - AeM_September_2022

P. 6

RESEARCH, ANALYSIS & TRENDS

the weakening of the local currency. Whereas Indone- back by complementing macroeconomic stabilization

sia and Australia, which export commodities such as measures," says Mario Allen Clement, Associate Re-

coal, oil, and gas, have benefited from the current situ- search Manager, IT Spending Guides, IDC Asia/Pacific.

ation. Their inflation results from the increasing demand "Enterprises may continue to focus on operational effi-

due to the opening of the economy and supply chain ciency. However, new initiatives may be stalled," he

constraints. With China as their largest trading partner, added.

many Asia/Pacific countries were hit due to lockdowns

in China. IDC assumes that the Chinese economy will Education is expected to grow slower in 2023 as IT in-

stabilize and return to growth in 2023. The industries in vestments may be stalled due to excess and sudden

these countries are therefore impacted in different spending in 2021, followed through in 2022. Wholesale

ways. is expected to have a higher bounce back as budgets

focus on improving omnichannel selling, growing com-

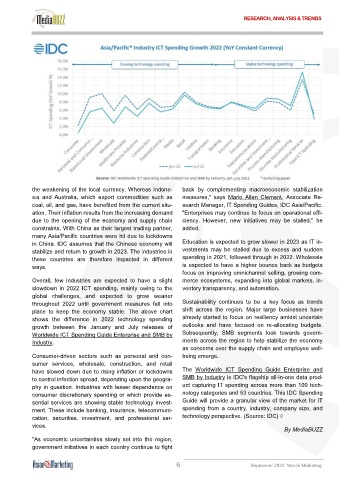

Overall, few industries are expected to have a slight merce ecosystems, expanding into global markets, in-

slowdown in 2022 ICT spending, mainly owing to the ventory transparency, and automation.

global challenges, and expected to grow wearier

throughout 2022 until government measures fall into Sustainability continues to be a key focus as trends

place to keep the economy stable. The above chart shift across the region. Major large businesses have

shows the difference in 2022 technology spending already started to focus on resiliency amidst uncertain

growth between the January and July releases of outlooks and have focused on re-allocating budgets.

Worldwide ICT Spending Guide Enterprise and SMB by Subsequently, SMB segments look towards govern-

Industry. ments across the region to help stabilize the economy

as concerns over the supply chain and employee well-

Consumer-driven sectors such as personal and con- being emerge.

sumer services, wholesale, construction, and retail

have slowed down due to rising inflation or lockdowns The Worldwide ICT Spending Guide Enterprise and

to control infection spread, depending upon the geogra- SMB by Industry is IDC's flagship all-in-one data prod-

phy in question. Industries with lesser dependence on uct capturing IT spending across more than 100 tech-

consumer discretionary spending or which provide es- nology categories and 53 countries. This IDC Spending

sential services are showing stable technology invest- Guide will provide a granular view of the market for IT

ment. These include banking, insurance, telecommuni- spending from a country, industry, company size, and

cation, securities, investment, and professional ser- technology perspective. (Source: IDC) ◊

vices.

By MediaBUZZ

"As economic uncertainties slowly set into the region,

government initiatives in each country continue to fight

6 September 2022: Mobile Marketing